Home

admin2023-11-22T07:47:52+00:00

HOT SALE

-

All products, big-sale-20-off

Design Design Cars Pattern Birthday Card – His Online Sale

0 out of 5$14.05$4.21 -

All products, big-sale-20-off

Design Design 418-10071 Happy Tears Hankie Fashion

0 out of 5$11.86$3.56 -

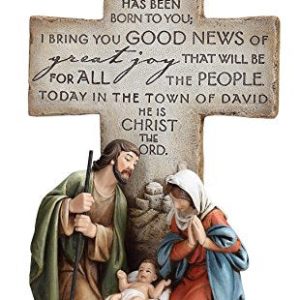

All products, figurine

Creative Brands CB Gift A Savior Is Born Holy Family Figurine, 12″ Hot on Sale

0 out of 5$51.66$10.33 -

-

All products, figurine

Precious Moments Confirmation Angel Bisque Porcelain Figurine 163052 Supply

0 out of 5$45.00$9.00 -

All products, christmas

Melrose 83935 Votive Holder, 3-inch Height, Glass Fashion

0 out of 5$18.67$5.60

Top Rated Products

-

All products, christmas

Beistle 22132 15-Piece Glittery Snowflake Clings-1 Sheet on Sale

0 out of 5$10.13$3.04

Best Selling Products

-

All products, christmas

Beistle 22132 15-Piece Glittery Snowflake Clings-1 Sheet on Sale

0 out of 5$10.13$3.04

Subscribe to Our Newsletter

Get all the latest information on Events, Sales and Offers.